Honestly, this video only showed how well designed the Soyuz was that even many decades later, only incremental improvements were needed rather than a fundamental change to the core design.

Droplet

Will the American Vasily Arkhipov make the right call this time?

Fun fact: Denzel Washington played this character in the American rendition of this incident in Crimson Tide.

Because he’s the pied piper candidate!

Hillary called Trump one night and said, “hey, why don’t you infiltrate the Republican Party and mess up their primaries so I can win?”

The proof is in the name. It’s (D)onald not (R)onald. We have exposed a Democrat spy in the Republican party.

The petrodollar is a weapon, that’s it.

The US forced oil producing countries to sell their oil in USD, and when those countries that formed a cartel called OPEC tried to use those dollar earnings to industrialize themselves, the US said, no, you’re not allowed to purchase critical assets within the US shores, you’re only allowed to use them to purchase US weapons and treasury bonds (i.e. you sell oil, we give you junk papers).

That’s it. It allows the US to control global oil (energy) trade but the oil producing countries get junk papers in return. By stop selling oil in dollars, it simply allows those countries to stop accumulating junk papers. It doesn’t stop the US to continue to control the global oil trade with all the institutions it has already set up all over the world, and especially with the US itself being one of the largest oil producing countries in the world.

There has been so much myth about the petrodollar but the key point really boils down to: the US prints its own currency, its spending doesn’t need to be financed by the treasury bonds. When the US spends overseas, foreign central banks that earned the dollars cannot buy anything the US doesn’t allow, so they recycled those dollars back to the US as treasury bonds, which allows the US to control the amount of circulating dollars overseas (i.e. allowing it to spend even more money overseas since all the surplus dollars have been absorbed back to the US treasury). This is the secret behind the US getting “free ride” all across the world.

Crank “anti-globalists” love this petrodollar myth because they think they can somehow de-throne the dollar with cryptocurrencies or the gold, without even understanding how the global financial system works.

Also, reminder of this news (posted to news mega at the end of May):

Boeing decided not to fix the helium leak from the Starliner spacecraft before sending the first crew to the ISS

Although the oxygen valve on the Atlas V rocket was replaced, Boeing and NASA decided to launch the Starliner with two astronauts to the ISS without replacing a small seal on the helium supply system in the service compartment. The leak affects only one of the 28 engines used to control the spacecraft's altitude, and is small enough to be dangerous, and taking the ship to the workshop and completely rebuilding it is time-consuming and ineffective. Instead, engineers will monitor the leak before the launch on June 1, and if it does not increase, the launch will go ahead.

Surely nothing would go wrong. Surely.

This is the FIFTH helium leak they’d gotten so far, and we’re not even at the end of the mission yet.

Seriously I’d rather take the Soyuz (the AK-47 of spacecrafts) if my life ever depends on it than any of these over-engineered crap.

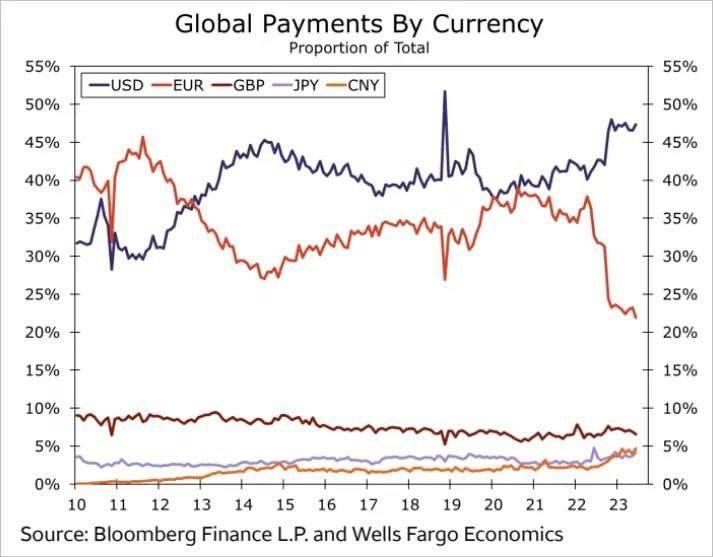

It’s funny, of all the anti-China and anti-US collapse rhetoric from both sides, the one thing I’m certain I will see in my lifetime is the euro turned irrelevant, if not disappeared completely.

Actually it is Germany who is in desperate need of the dollar, not Russia.

The euro is fast becoming irrelevant in global economy, and after losing Nord Stream, they now need to spend dollars (not euros) to import energy from America:

The EU, especially Germany, has lost its energy and monetary sovereignty since Ukraine and they now have to earn US dollars to survive.

All of this is just projection. Keep the dollar banknote to yourself in case you need it one day.

Russia is a very weird case. You have clearly two branches: the Ministers of Cabinet and the Central Bank running their separate policies on diverging ideological grounds.

For example, the Central Bank (the most neoliberal of all) has been keeping the interest rate high at 16% all this while, on the pretext of “curbing inflation”. At the same time, the Ministers of Cabinet counter-act the Central Bank monetary policy by giving out preferential loans (subsidizing the high interest rates) to stimulate the economy.

So, the end result is that the Central Bank has been trying to tighten the money supply (via high interest rate), but the government keeps lending at a low rate for prioritized development projects. This is why you see so much of the investment in Russia has gone into military spending, because it is one area that the government has near total control of.

Meanwhile private investments have held back due to the high interest rates, only choosing to take the cheap loans where the state has priorities in. In other words, the state has become the biggest customer and investor of the Russian economy.

It’s a very strange economy where both the state and the central bank (which is independent) are fighting against one another. So far, the liberal Central Bank’s strategy to cut back investment and spending is on the losing side, as evident by the increased wages and consumption and low unemployment. But this contradiction cannot end until the Central Bank has been fully absorbed into the government as a State Bank, just like it did during the times of the USSR.

US imperialists are learning, by ramping up financial warfare against Russia once again. The first time might have failed, but they are trying again:

The thought persists that sanctions against Moscow Exchange and National Clearing Center (NCC) are the Americans’ plan number two, after plan number one had no effect. Yes, sanctions don't work. But they may not work in the opposite direction. Will explain.

After the start of the SMO, under the conditions of the first restrictions, a strong trade balance surplus arose in the Russian Federation. There was too much currency coming into the country, and there was nothing to spend it on. As a result, the ruble strengthened significantly. Everyone remembers how much the dollar fell. Russian (especially raw materials) exports then approached the threshold of unprofitability; The government also recorded a sharp drop in revenue. At the end of 2022, the Ministry of Finance announced the need to lower the ruble exchange rate in order to help exporters survive and fulfill the federal budget themselves. This was done last summer.

Question: why didn’t the Americans impose sanctions against Moscow Exchange and NCC in 2022, but did it only now. I think that they studied the situation and realized that for the Russian economy it is not the dollar at 200 rubles that is scary, but rather the dollar at 50 rubles. It seems that this is the plan that will now be implemented. For example, how will the largest exporters now sell foreign currency earnings? This is one of the pillars of maintaining the course at the desired level. The currency received from Russian exports was sold on the Moscow Exchange by the so-called SZKO. On average from $800 million to $1 billion daily. The largest buyers of foreign currency were non-resident banks. This was convenient, since the Americans prohibit transactions with sanctioned Russian banks. Now the exchange is closed, and you cannot buy currency directly from SDN banks. I'm not a forecaster, but I want to highlight the risks. Sanctions against the Moscow Exchange may not weaken the ruble, but strengthen it. With the sole purpose of causing damage to exporters and reducing federal budget revenues. The Americans have been achieving this since 2022. Now they are on their second run.

This is once again a double-edged sword. The Russians could choose to submit to the rules set by the global hegemon as usual, or it could end up pushing them further away from neoliberalism.

The Americans are gambling that Russia wouldn’t dare to abandon neoliberalism, and they might turn out to be right once more.

I still don’t understand why Cuba chose to host the Russian Navy. Are they trying to upset the US and invite more sanctions against them?

Or were they blackmailed by the Russians: if you don’t let us park our warships at your shores, we will not send you food and oil?

Putin is playing a dangerous game here and I don’t see how this could contribute to de-escalation from a nuclear war.