Uhhh... Can someone ELI18 to me the problem with passkeys? I use them wherever available and find them very convenient.

memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads/AI Slop

No advertisements or spam. This is an instance rule and the only way to live. We also consider AI slop to be spam in this community and is subject to removal.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

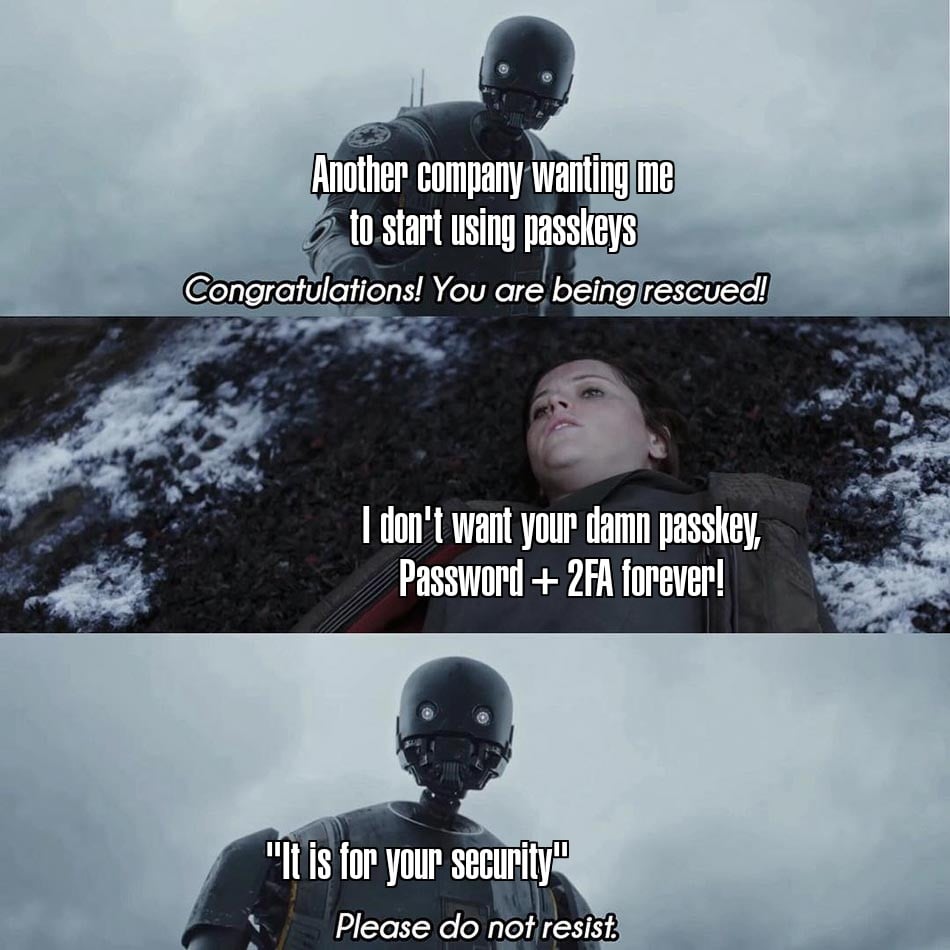

Yeah i can sum it up for you

sure, you can use a passkey as a primary authentication, but only "a device" or "system"(keypass/1pass etc) knows the passkey detail. with only passkey, if my passkey provider/ device is compromised then everything is lost. having single factor auth seems like a bad idea.

a password is something that I can know, so is still useful as a protection mechanism. having two factor auth should include password and passkey, which seems entirely reasonable whilst also providing an easier path forward for people used to TOTP.

Has this energy...

I'll use banks as an example

If they cared about your security there would not be a mobile app or website.

Hell, credit cards would still require a signature.

It's about cost first and foremost and then convenience.

Has nothing about you as a consumer. They don't give 2 shits about you as a consumer.

I mean you're right about banks but your examples make no sense.

Banks generally don't support 2fa, which is bad. Some banks (fidelity) still have character limits on passwords because they stores it in plaintext until recently so you could use it through the telephone system. They could implement a secure tap to pay system on your phones with enhanced security, rather than relying on Google to handle their job. And for credit cards themselves, switch to chip and pin.

"Banks don't have mobile apps"?? "Signatures are secure"?????🤡

I have no idea what a passkey is and I will probably only learn what it is when they become mandatory

I will just use passwords + 2FA for the moment

Passkeys are phishing resistant, or so they say... but the web app still needs to let you in with password + 2FA... So I'm not sure how much that's really worth.

I guess if the users are typically never seeing a 2FA prompt then it should be more suspicious when they see one?

Passkeys are a replacement for passwords. Passwords don’t solve the problem of a lost password, and passkeys don’t solve the problem of a lost passkey. How a site deals with lost credentials is up to them. It doesn’t need to be password + 2FA.

I just wish Google would stop overriding my passkey on Android for specific apps including their own.

Y’all are my people.

Coincidence or did you get that email from eBay today, too?

They probably got hacked and we'll find out about it next year.