If only the suckers could support a different reality tv clown.

archive.today • Truth Social investing is about faith in Trump, not business fundametals - The Washington Post

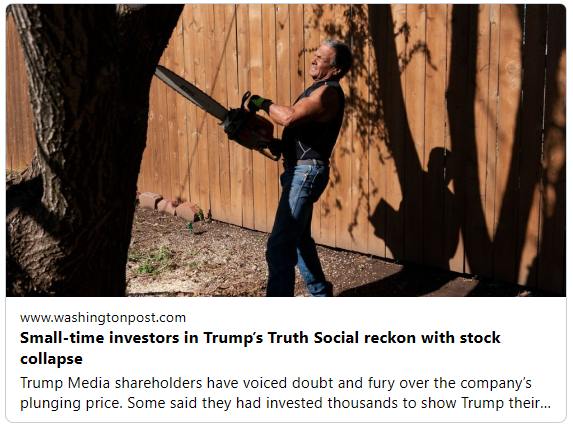

Jerry Dean McLain first bet on former president Donald Trump's Truth Social two years ago, buying into the Trump company's planned merger partner, Digital World Acquisition, at $90 a share. Over time, as the price changed, he kept buying, amassing hundreds of shares for $25,000 — pretty much his "whole nest egg," he said.

That nest egg has lost about half its value in the past two weeks as Trump Media & Technology Group's share price dropped from $66 after its public debut last month to $32 on Friday. But McLain, 71, who owns a tree-removal service outside Oklahoma City, said he's not worried. If anything, he wants to buy more. "I know good and well it's in Trump's hands, and he's got plans," he said. "I have no doubt it's going to explode sometime."

For shareholders like McLain, investing in Truth Social is less a business calculation than a statement of faith in the former president and the business traded under his initials, DJT.

[...]

McLain [said] he believes the stock could "go to $1,000 a share, easy," once the media stops writing so negatively about it and the company works through its growing pains. The company's leaders, he said, are being "too silent right now" amid questions about the falling share price, but he suspects it's because they're working on something amazing and new.

McLain is an amateur trader — he invested only once before and "lost [his] butt" — and said he hasn't talked to his family about his investment, saying, "You know how that is." But he believes the Trump Media deal is a sign he is "supposed to invest," he said. "This isn't just another stock to me. … I feel like it was God Almighty that put it in my lap," he said. "I've just got to hold on and let them do their job. If you go on emotion, you'll get out of this thing the first time it goes down."

I don't understand stocks.

Could someone end up owing money if their stock purchase falls into negative value? Or would they only be out their purchase?

If you own stock, the worst case scenario is it just becomes worthless. It's all the other stock market shit, the stuff that's basically gambling or taking out loans, that can result in actually owing money.

no, if you buy a stock, the most you could lose is 100%.

you could only 'go negative' and owe money if you short a stock, or sell options, etc.

You're thinking of shorting a stock. You sign a contract to sell a stock. And the most dangerous version of it is naked short selling where don't even own the stock.

--

Ninja edit

ELI5: Short selling : explainlikeimfive

Top comment

Capitalism is so rational that not only can you trade things that are intangible and nonexistent materially, but you can also trade things that are intangible and nonexistent even on paper

Don’t forget you can pay to rent these intangible things for a fixed period of time.

A Reddit link was detected in your comment. Here are links to the same location on alternative frontends that protect your privacy.

Oh, that was actually very helpful. Thanks!