this post was submitted on 30 Dec 2024

1106 points (99.1% liked)

196

18238 readers

93 users here now

Be sure to follow the rule before you head out.

Rule: You must post before you leave.

Other rules

Behavior rules:

- No bigotry (transphobia, racism, etc…)

- No genocide denial

- No support for authoritarian behaviour (incl. Tankies)

- No namecalling

- Accounts from lemmygrad.ml, threads.net, or hexbear.net are held to higher standards

- Other things seen as cleary bad

Posting rules:

- No AI generated content (DALL-E etc…)

- No advertisements

- No gore / violence

- Mutual aid posts are not allowed

NSFW: NSFW content is permitted but it must be tagged and have content warnings. Anything that doesn't adhere to this will be removed. Content warnings should be added like: [penis], [explicit description of sex]. Non-sexualized breasts of any gender are not considered inappropriate and therefore do not need to be blurred/tagged.

If you have any questions, feel free to contact us on our matrix channel or email.

Other 196's:

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

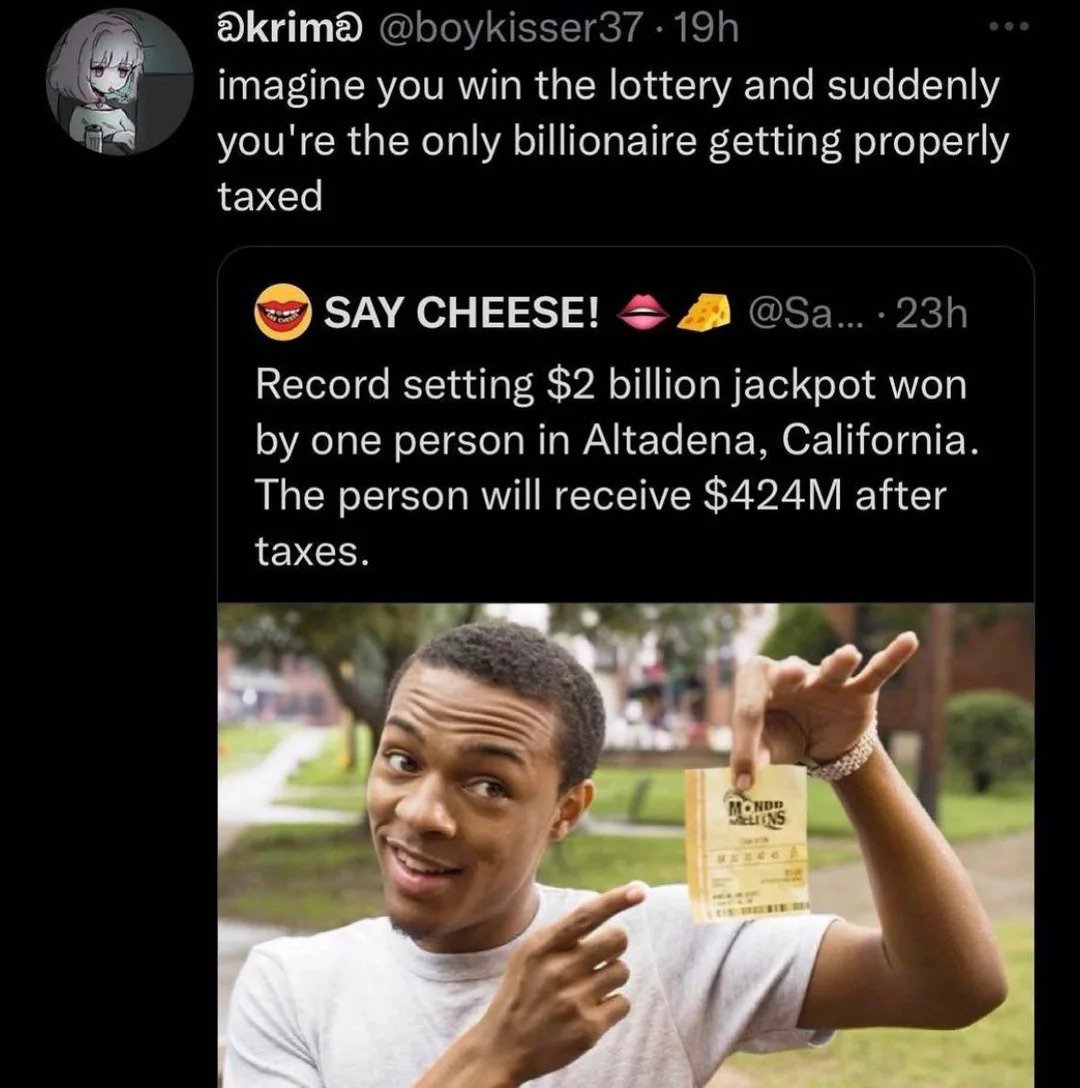

Lotterys are usually paid out in annuities where you would get that amount over a period of 10-30 years. However, they also give a lump sum amount which is usually ~half the stated amount and after taxes you could expect to receive 1/3 the stated amount.

Still, it's generally best to take the lump sum unless you have very bad self control and would blow through the money.

Why? I would assume it's the other way round.

The lump sum will grow to be worth more than the annuity over the same period if properly invested

Wouldn’t you pay a lot more taxes on the lump sum and subsequent capital gains?

Not when invested properly. Using easy examples, if you win a million dollars and take it over 30 years, say you're taxed 20%, you get $800k. You choose to take a lump sum and they only give you 30% of the value, you get $300k. Investing that $300k at 5% over 30 years, you've got an additional $55k over what you would have gotten over the same time period. Now, the average market return rate is closer to 3-5% higher than that, so that 5% return is a conservative estimate of what you have after fees and pulling some out for yourself (3% is a recommendation I've heard), putting you well above what you'd get from the annuity.